Understanding money goes beyond numbers and transactions; it delves deep into our thoughts, feelings, and behaviors. This complex relationship with money shapes our choices, influences our lives, and even defines our self-worth. In this article, we’ll explore the psychology of money, unraveling our motivations and emotional ties with our finances.

What is Money Psychology?

Money psychology is a branch of psychology that examines how our emotions and beliefs about money affect our financial decisions. It investigates why we spend, save, invest, or hoard money in specific ways. It’s about understanding the feelings and attitudes that drive our financial behaviors.

- Emotions: Money is often tied to intense feelings, like fear, guilt, or happiness.

- Beliefs: Our upbringing and experiences shape our beliefs about money, influencing how we view wealth and success.

- Behavior: Our decisions about earning, spending, and saving are often based on our psychological relationship with money.

The Origins of Our Money Mindset

Our attitude toward money is shaped from a young age, influenced by family, culture, and personal experiences. Here’s how these factors play a crucial role:

Family Influences

- Parental Attitudes: Parents’ views about money, whether positive or negative, can significantly impact a child’s perspective. For instance, a parent who discusses finances openly may instill a sense of financial literacy.

- Financial Behavior Modeling: Children often mimic their parents’ financial behaviors. They will likely adopt similar habits if they see their parents budgeting and saving.

Cultural Impact

Culture plays a vital role in shaping our beliefs about money. Different cultures have various attitudes toward wealth, debt, and saving, which can affect how individuals perceive money.

- Collectivist Cultures Often emphasize saving and financial security for the family unit.

- Individualistic Cultures May focus more on personal success and wealth accumulation.

Personal Experiences

Individual experiences with money can profoundly shape our perceptions. Positive experiences may lead to confidence in financial decision-making, while negative experiences, such as economic hardship, can foster anxiety or fear.

Common Psychological Barriers to Financial Success

Understanding the psychological barriers that hinder financial success is vital to overcoming them. Here are some common barriers:

Fear of Failure

Many people fear making financial mistakes, leading to analysis paralysis. This fear can prevent individuals from investing or pursuing opportunities that could lead to economic growth.

Instant Gratification

The desire for immediate rewards can lead to overspending. With the rise of online shopping and credit cards, the temptation to indulge in instant gratification is more prevalent than ever.

Financial Illiteracy

A lack of understanding of financial concepts can create feelings of insecurity. Individuals may only undertake financial planning with knowledge, leading to missed opportunities.

Scarcity Mindset

People with a scarcity mindset believe there’s never enough money. This perspective can lead to hoarding behaviour, where individuals save excessively and avoid spending even on necessary items.

The Role of Money in Self-Identity

Our financial situation often becomes intertwined with our self-identity. For many, money is not just a means of exchange; it symbolizes success, status, and worth.

Social Status and Money

In many societies, financial success is equated with social status. People often use money to signal their social standing through possessions, lifestyle choices, or experiences.

- Consumerism: The pressure to keep up with societal standards can lead to excessive spending.

- Status Symbols: Luxury items or exclusive experiences are often used to project wealth and success.

Money and Self-Worth

For some individuals, self-worth is tied to their financial status. This connection can create pressure to earn more, leading to stress and anxiety.

- Comparison Culture: Social media can exacerbate feelings of inadequacy as people compare their financial situations to others.

- Financial Success as Validation: Individuals may believe that their wealth defines their worth, leading to a constant pursuit of financial achievements.

Strategies for Improving Your Money Mindset

Developing a healthy relationship with money requires introspection and proactive strategies. Here are some effective methods to consider:

Set Clear Financial Goals

Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals can help direct your financial decisions. Consider the following:

- Short-term goals include saving for a vacation or paying off a small debt.

- Long-Term Goals: These include saving for retirement or buying a home.

Practice Mindfulness Around Money

Being mindful about your financial habits can foster a healthier relationship with money. Here are some ways to practice mindfulness:

- Budgeting: Track your spending and saving habits to clarify your financial situation.

- Reflective Spending: Before purchasing, ask whether it aligns with your values and financial goals.

Educate Yourself

Financial literacy is crucial for making informed decisions. Here are some resources you can explore:

- Books and Articles: Look for literature that explains financial concepts in an accessible manner.

- Workshops and Seminars: Attend local or online events to enhance financial knowledge.

Shift Your Mindset

Changing your money mindset can be transformative. Here are some strategies to help shift your perspective:

- Adopt an Abundance Mentality: Focus on opportunities rather than limitations. Believing that there are enough resources for everyone can alleviate feelings of scarcity.

- Celebrate Financial Wins: Acknowledge and reward yourself for reaching financial milestones, no matter how small. This can boost your confidence and reinforce positive behaviors.

The Importance of Financial Planning

Financial planning is crucial for managing money effectively. It helps individuals understand their current economic situation, set goals, and develop strategies to achieve them.

Benefits of Financial Planning

- Clarity and Control: A well-thought-out financial plan clarifies your financial situation, allowing you to make informed decisions.

- Preparedness for the Future: Financial planning prepares you for unexpected expenses and retirement, ensuring you’re not caught off guard.

- Reduced Stress: Knowing that you have a plan can minimize anxiety surrounding money.

Components of a Financial Plan

A comprehensive financial plan should include the following elements:

- Budgeting: Track income and expenses to create a realistic budget.

- Emergency Fund: Set aside funds for unexpected costs, ideally covering three to six months of living expenses.

- Debt Management: Develop a strategy to pay off debts systematically, prioritizing high-interest debts.

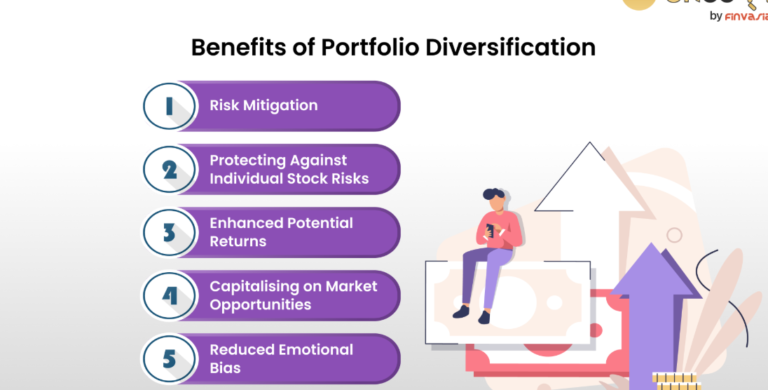

- Investment Strategy: Create a plan for investing your money to achieve long-term financial growth.

The Impact of Technology on Money Psychology

Technology has drastically changed the way we manage money. With the rise of online banking, budgeting apps, and cryptocurrency, our relationship with money continues to evolve.

Digital Banking and Apps

Online banking has made financial management more accessible. Here’s how technology aids money management:

- Real-Time Tracking: Apps can track spending in real time, providing insights into financial habits.

- Automated Savings: Many apps allow users to automate savings, making it easier to reach financial goals.

Cryptocurrency and Investing

The advent of cryptocurrency has opened new avenues for investment. However, it also brings unique psychological challenges.

- Volatility: The unpredictability of cryptocurrencies can lead to heightened emotions around investing.

- FOMO (Fear of Missing Out): The hype surrounding crypto can create pressure to invest, sometimes leading to impulsive decisions.

Conclusion: Embracing a Healthy Relationship with Money

Understanding the psychology of money is essential for developing a healthier relationship with finances. We can overcome barriers and make informed financial decisions by exploring our beliefs, behaviors, and emotional ties to money.

Remember, it’s not just about the numbers; it’s about how money influences our lives, choices, and well-being. Embracing positive strategies, setting clear goals, and cultivating financial literacy can empower us to take control of our economic futures.

Ultimately, the psychology of money teaches us that our relationship with money can be a powerful tool for personal growth and fulfillment. By fostering a positive mindset, we can navigate the complexities of finances with confidence and clarity.