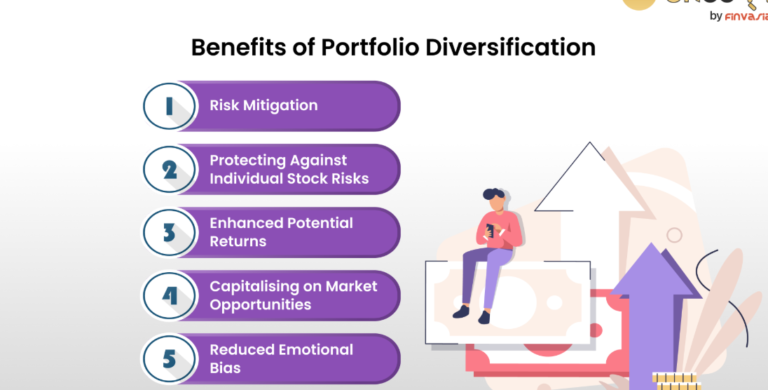

Diversification is a fundamental principle of sound investing, recognized by both experienced investors and financial advisors. At its core, diversification involves distributing investments across multiple asset classes, industries, and regions to balance risk and optimize returns. Below are four key reasons why diversifying your portfolio is essential for achieving sustainable, long-term financial growth.

Reduces Overall Risk

Every investment carries a degree of risk, but diversification helps mitigate the impact of losses tied to any single asset or sector. By allocating investments across a range of industries, asset classes, and geographies, you create a safeguard against market fluctuations. For instance, if one sector experiences a downturn, more stable assets in your portfolio can help offset those losses, maintaining balance and minimizing overall risk. A diversified portfolio creates a robust financial foundation, ensuring no single investment jeopardizes your financial objectives.

Enhances Potential Returns

A thoughtfully diversified portfolio capitalizes on opportunities across various markets by investing in high-performing assets in different sectors. Since markets and asset classes respond differently to changing economic conditions, diversification increases the likelihood of achieving consistent and higher returns over time. Gains from certain areas of your portfolio can offset potential losses in others, leading to a smoother growth trajectory. Warren Buffett’s Berkshire Hathaway illustrates this approach effectively. By investing across industries such as insurance, technology, energy, and consumer goods, Berkshire Hathaway has demonstrated resilience in the face of market fluctuations, achieving sustained growth and stability.

Protects Against Economic Uncertainty

The global economy is inherently unpredictable, influenced by dynamic geopolitical events and market conditions. Diversification acts as a safeguard against this uncertainty. By including a range of investments—spanning regions, industries, and asset classes like stocks, bonds, and real estate—you reduce vulnerability to economic shocks. This approach also provides exposure to emerging markets and industries, fostering steady financial growth while minimizing volatility. A diversified portfolio helps you navigate uncertain economic cycles with greater confidence and stability.

Supports Long-Term Stability

Diversification is a cornerstone for building a stable and resilient portfolio. By balancing investments across assets with varying risk profiles, you reduce sensitivity to market fluctuations and establish a strategy that adapts to evolving conditions. This approach not only mitigates the impact of losses but also ensures consistent progress toward your long-term financial goals. For example, a diversified portfolio that includes a mix of stocks, bonds, and real estate offers a balance between higher-reward opportunities and more secure investments. This balance aligns your portfolio with your risk tolerance and financial objectives, fostering sustained growth and stability over the long term.

Diversification is key to successful investing, helping reduce risk, enhance returns, and provide stability during market fluctuations. Ed Rempel, a financial planner with 26+ years of experience, advocates for effective diversification. Numerous Ed Rempel reviews highlight his ability to simplify complex financial concepts and implement practical, growth-oriented strategies for his clients. Ed Rempel review emphasizes his pragmatic approach to wealth management, dedicated to assisting clients in achieving their long-term financial objectives. Whether you are a seasoned investor or new to investing, diversification remains a critical tool for navigating market challenges and achieving a resilient, growth-focused portfolio.